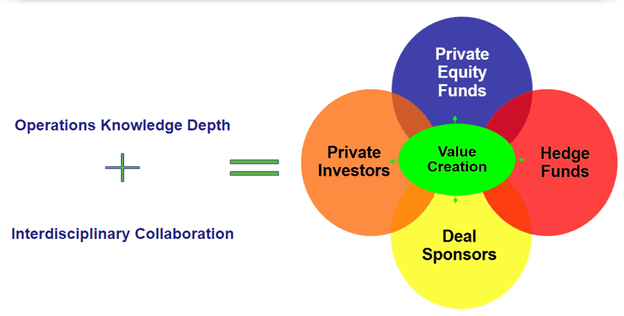

Why are We Different?

Operations Knowledge Depth Across All Asset Sector

Our Sector Specialists exemplify true ground-up operational

proficiency, paired with top-down capital markets perspective. We

are the only sector specialist network focused exclusively on

independent investment strategy analysis.

__________________________________________________________________________

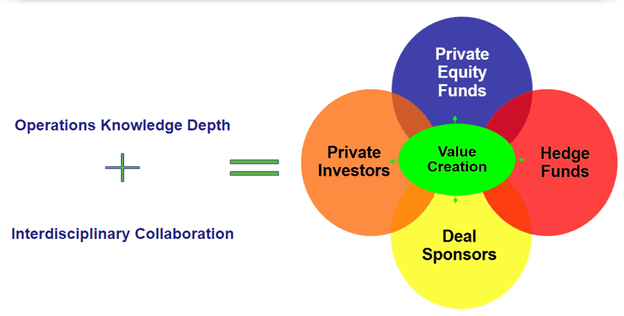

Private & Institutional Market Analysis

Our client base consists of private equity funds, hedge funds,

venture capital funds, private investors, and deal sponsors.

Collectively, we utilize the Lgreen Network's extensive market

knowledge and financial analytics competencies.

__________________________________________________________________________

Standardized Private Market Analytics

The current direct investment marketplace is highly fragmented,

with no common reference point for risk adjusted investment value.

Lgreen NAV provides this reference point for investors, deal

sponsors and service providers, driven by top experts and further

verified by Lgreen's unparalleled direct investor access.

Lgreen NAV covers ALL Asset Sectors. Here is a sampling of the most requested. If you don't see your specific requirement, keep in mind that the unique Lgreen Network enables us to tap into Sector Specialists quickly, with strong referrals, across the world.

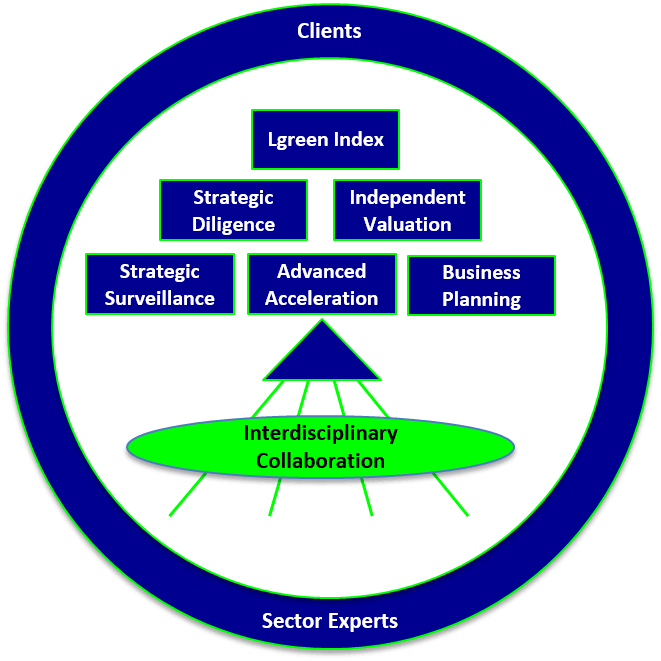

Lgreen Index

Strengthens investment returns by

fostering value drivers and identifying

weaknesses on an early stage basis.

Cost effectively captures Sector Specialist knowledge depth and capital markets perspective utilizing standardized risk attributes. Lgreen Index Scorecard rates risk adjusted return against market norms. Enhancement option to capture direct investor feedback using the same standardized scorecard methodology.

Strategic Diligence

Identifies latent value drivers and risks overlooked by competition using multidisciplinary team expertise.

Sector Specialists provide asset specific operations knowledge depth to diligence direct investments while contributing private and institutional capital markets intelligence. Utilizing multiple Sector Specialists across disciplines yields unparalleled investment diligence that is otherwise impractical to bring in house. Advanced enhancement options include skill specific specialists such as Geospatial Analysis, Machine Learning, and Stochastic Modeling.

Independent Valuation

Drives investor confidence and grows AUM via independent investment value transparency.

Single source provider of fair value and audit support across asset classes for hedge funds, private equity funds, and private investors. Lgreen NAV's work product stands apart from all other valuation providers; we don't believe in opaque, "black box" methodology. Valuation reports stand on their own merit as they are comprehensive, transparent, and easily understood.

Advanced Acceleration

Rapidly accelerates equity value growth by capturing direct perspective from accomplished industry veterans.

Lgreen NAV pairs deal sponsors and with private investor principals from the Lgreen Capital platform. These investor principals are accomplished in their respective asset classes and provide direct mentorship to accelerate the deal sponsor's success.

Strategic Surveillance

Early stage warning system addresses investment value volatility using independent, asset specific perspective.

Ongoing investment performance tracking by analyzing and reporting historical deal performance, current market trending, and ongoing investment strategy adjustments. Strategic Surveillance is a strong asset management tool to identify investment performance pitfalls and latent value drivers on an early stage basis.

Business Planning

Focuses investment execution on highest value add elements.

Market analysis, customer segmentation, highest value application, financial modeling, and business plan compilation tailored to the client's investment strategy.

We are absolutely confident that our services will create value for you. Please contact us below so that we can discuss your specific requirements.

Qualified institutional investors will receive a complimentary consultation with Sector Specialists to define specific value-add strategies. Contact us now for this offer. Limitations apply.